- Activities

MAPS is a collective effort proposing new ways and approaches of storytelling to address the world's changing environment and societies.

MORE- Works

- Cultural

- Education

- Collective projects

- Members

MAPS brings together various dedicated professionals who want to start a new adventure and learn from each other in the process.

MORE- Photographers

- Creatives

- Contributors

- Foundation

Series

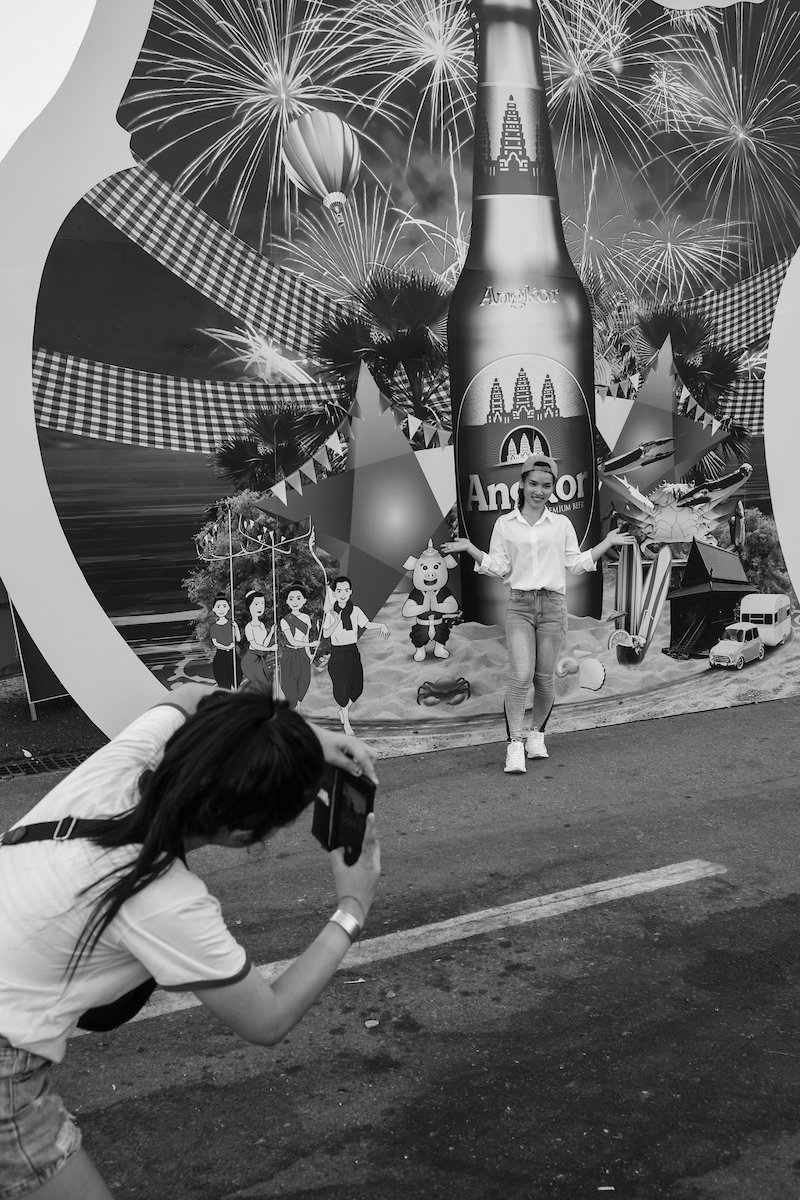

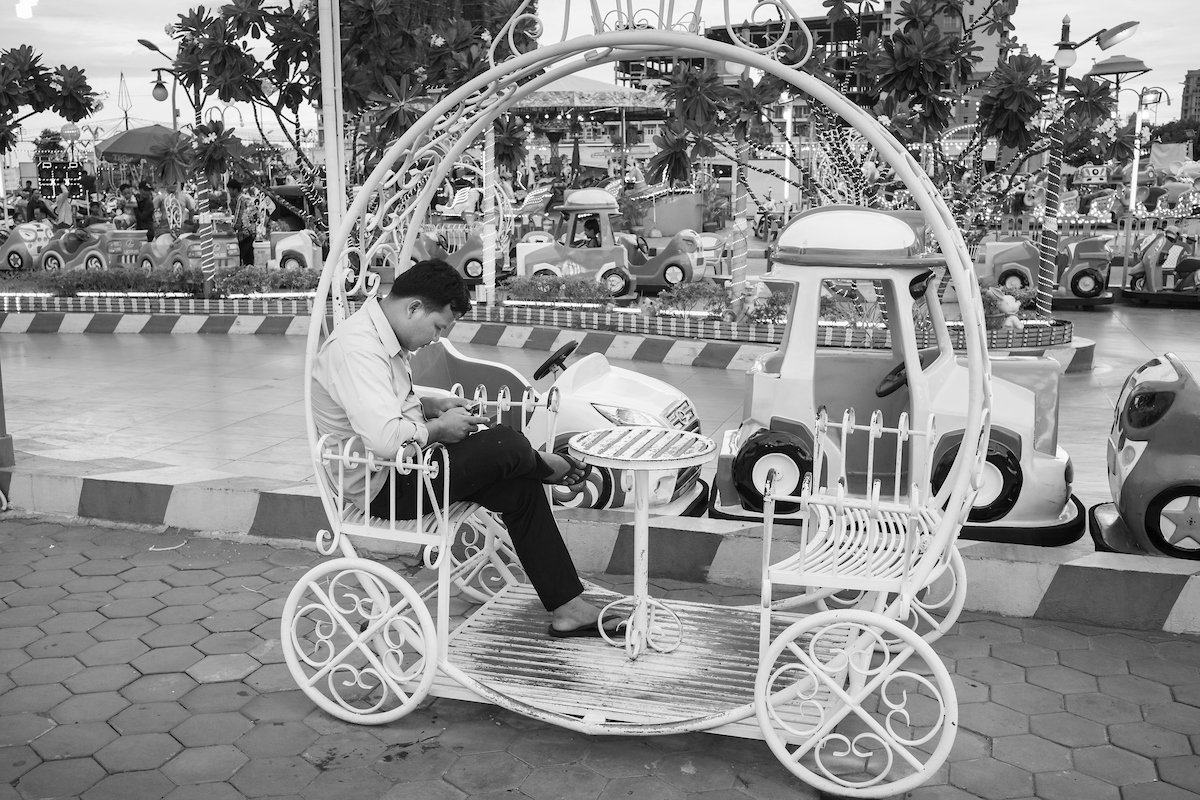

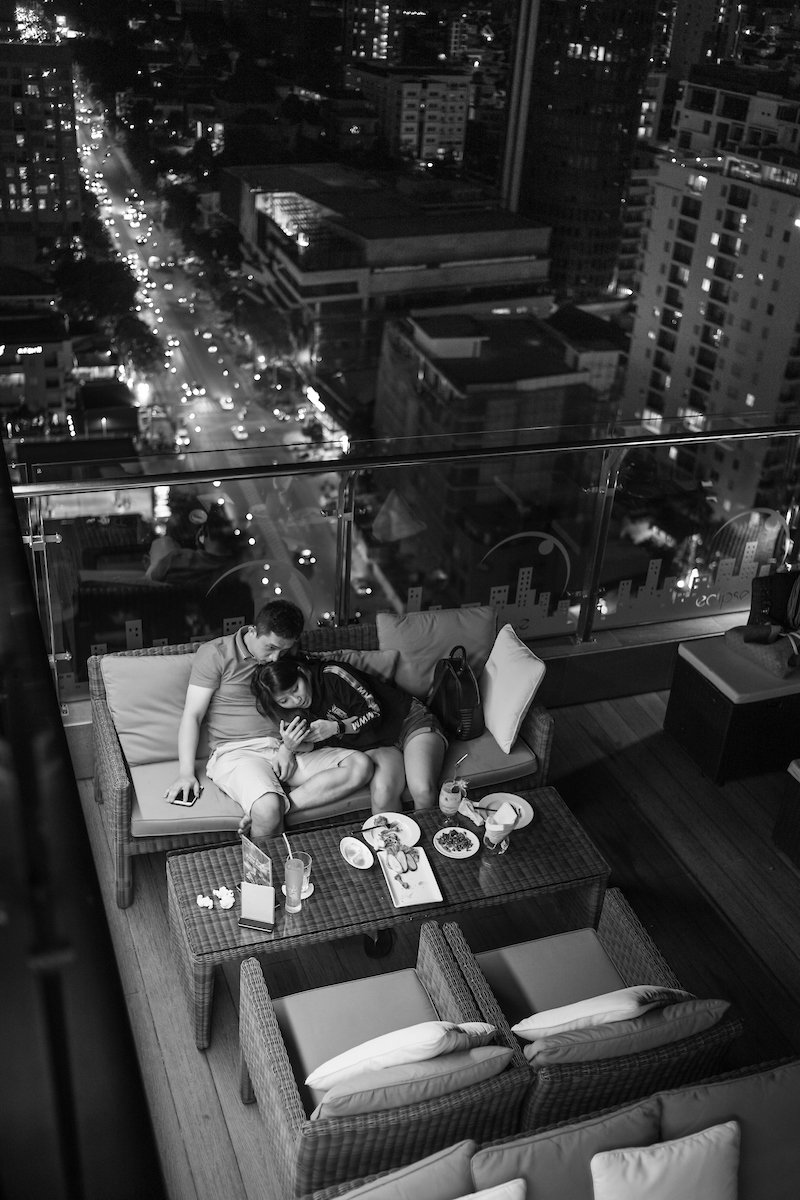

Cambodia, the Lure and its Curse

Shiny things are like a car coming towards you at night: you can’t see anything else but the light.

Cambodia is steaming full speed ahead on the path of development. There is peace, and if there is no real political freedom in this recently established autocracy, there certainly is freedom for entrepreneurship in an unbridled liberal economy system. Growth for last year was 7,5%.

Investments are soaring. High rises with condo’s for the new middle-class with salaries of 2000-3000$/month are popping up all over Phnom Penh. In the ever expanding suburbs, hundreds of 40000$ houses are being (poorly) built in the ‘boreys’ for those with a more modest income. There are state-of-the-art shopping malls. Streets are jammed with shiny SUV’s and motorbikes. All the restaurants, be they expensive or cheap, are crowded every night. In the countryside cows are replaced by tractors, tin sheet roofs are replaced by tiles, new motorbike shops line the markets.

There is human energy. There is excitement, there are opportunities. Careless consumerism has found a new haven to expand and thrive for the benefit of shareholders of all the international brands.

One of the consequences of consumerism in a country which lacks education in asset management is a nine-fold credit increase over the past 12 years, the fastest in East-Asia. World Bank states that outstanding loans provided by banks and microfinance institutions were worth over $25 billion or more than 100% of GDP. Out of a population of 15 million, 2,3 million are borrowing money. With an average debt per capita of 3370$, more than twice the average annual income of 1380$, onein-three of the Cambodian borrowers is over-indebted, according to a 2017 study by a coalition of microfinance investors. If credit is mostly called upon for health or agricultural emergencies, today the lure of consumer goods often surpasses urgent needs, and money is borrowed for non essential goods. In a weird paradox, households benefiting from the financial stability of

remittances sent by migrant workers in Thailand, South Korea, Malaysia or Japan (there are 2 million of them, double compared to 10 years ago, sending $400 million home) tend to increase their debt by 6%. According to a study by the Future Forum think tank, only a third of those loans were used for economical purposes, the rest going to non-essential or non-profitable goods. An August 2019 report by Cambodian NGO’s LICADHO and Sahmakum Teang Tnaut points out the fact that the use of land titles as a collatoral to a loan increases the number of landless. And as difficulties to reimburse increase, children are more often at risk of being forced to quit school and provide additional income to the household.